|

|

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

RFK Jr. Just Supercharged These 2 Biotech Penny Stocks

Biotech stocks have long enticed investors with the promise of outsized gains. Amid recent federal policy shifts, two previously under-the-radar names are catching attention. Last week, Health and Human Services Secretary Robert F. Kennedy Jr. announced plans to fast-track rare-disease drug approvals and promised a less cumbersome regulatory framework. That announcement aims to cement the U.S. as the global center of biotech innovation, which sent gene therapy shares sharply higher. Penny stocks like Sangamo Therapeutics (SGMO) and Editas Medicine (EDIT) have gained notable momentum, as both companies specialize in pioneering gene-editing platforms for rare disorders. Investors have assumed that they are both poised to benefit directly from an accelerated review process. For investors seeking speculative exposure to this opportunity, SGMO and EDIT offer a low-price entry point and, potentially high upside under the new accelerated-approval regime. However, investors should be warned that biotech penny stocks also carry outsized risks and volatility. Stock #1: Sangamo TherapeuticsBased in California, Sangamo Therapeutics (SGMO) specializes in genomic therapies, developing pipeline candidates like SB-525 for hemophilia A, SB-FIX for hemophilia B, and innovative STAC-BBB capsids to deliver treatments across the blood-brain barrier. Valued at a small market cap of $120 million, shares of this biotech company have underperformed in 2025, shedding 50.5% of their share value. However, the stock rebounded sharply last week, gaining nearly 8% on the news of RFK Jr.’s plans.

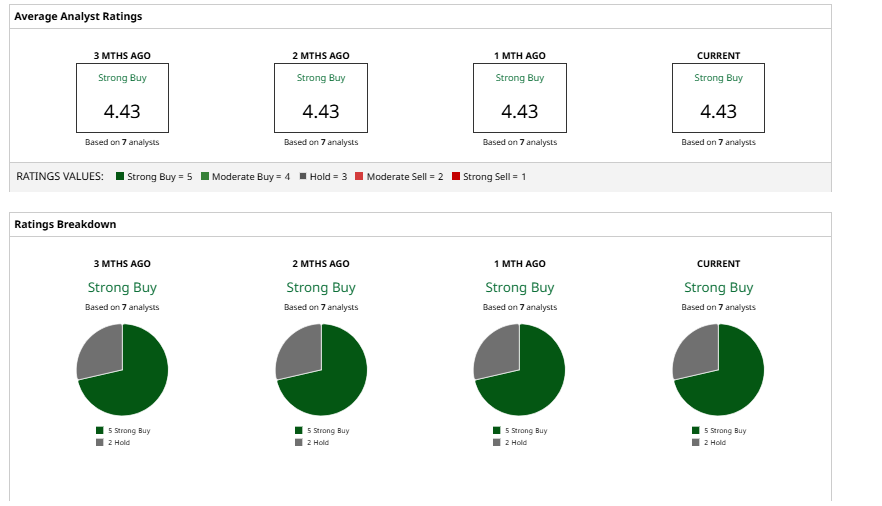

In the first quarter of 2025, Sangamo reported a GAAP loss of $0.14 per share, missing consensus estimates by $0.02, while revenue reached $6.4 million, falling $1.02 million short of forecasts. The company ended the quarter with cash and cash equivalents totaling $25.2 million, down from $41.9 million at year-end 2024. However, after receiving an $18 million upfront payment from Eli Lilly (LLY) in April 2025, Sangamo expects its liquidity, combined with $23 million raised in a recent equity offering and proceeds from an at-the-market program, to fund operations into late Q3 2025. Management reiterated its full-year 2025 GAAP operating expense guidance of $135 million to $155 million, alongside non-GAAP expenses of $125 million to $145 million. Additionally, the company reduced headcount and streamlined operations to extend its runway and support its lead candidate, isaralgagene civaparvovec, toward a potential Biologics License Application. As mentioned above, Sangamo recently priced an equity offering to raise $23 million. The proceeds from this offering position Sangamo to advance key programs. Analysts have a consensus “Strong Buy” rating on SGMO with a mean price target of $4.10, which implies expected 720% upside over current levels.

Stock #2: Editas MedicineEditas Medicine (EDIT) is a clinical-stage gene editing company headquartered in Cambridge, Massachusetts. It uses cutting-edge gene-editing technology to develop transformative therapies targeting serious diseases. Unlike SGMO, Editas Medicine has had a strong year, with shares skyrocketing more than 61% year to date, driven by encouraging preclinical data presentations.

Editas Medicine reported first-quarter 2025 revenue of $4.7 million, a 327% year-over-year increase. This performance occurred despite a wider net loss of $76.1 million or $0.92 per share, compared to $62.0 million in Q1 2024. Research and general administrative expenses decreased modestly, reflecting restructuring tied to the reni-cel program discontinuation. The company held $221 million in cash and equivalents at quarter-end, down from $269.9 million at Dec. 31, 2024. Management projects that this provides operational funding through the second quarter of 2027. Last month, Editas showcased preclinical data at the ASGCT meeting. One of the achievements the results showcased is its ability to increase the level of a key protein that can help address diseases caused by a loss of function or certain gene mutations. Executives also presented at the Bank of America Global Healthcare Conference in May. Looking forward, Editas anticipates nominating two in vivo gene editing candidates by mid-2025: one for hematopoietic stem cells and another for liver-directed therapy. Positive early human trial results could support valuation growth. Wall Street maintains a “Moderate Buy” consensus with a $3.22 mean price target, suggesting 60% potential upside from current levels.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|