|

|

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

The ‘Tesla of China’ Defies All Odds to Rise 93% in 2025: Is It Too Late to Buy the Stock Now?/EV%20in%20showroom%202%20by%20Robert%20Way%20via%20%20Shutterstock.jpg)

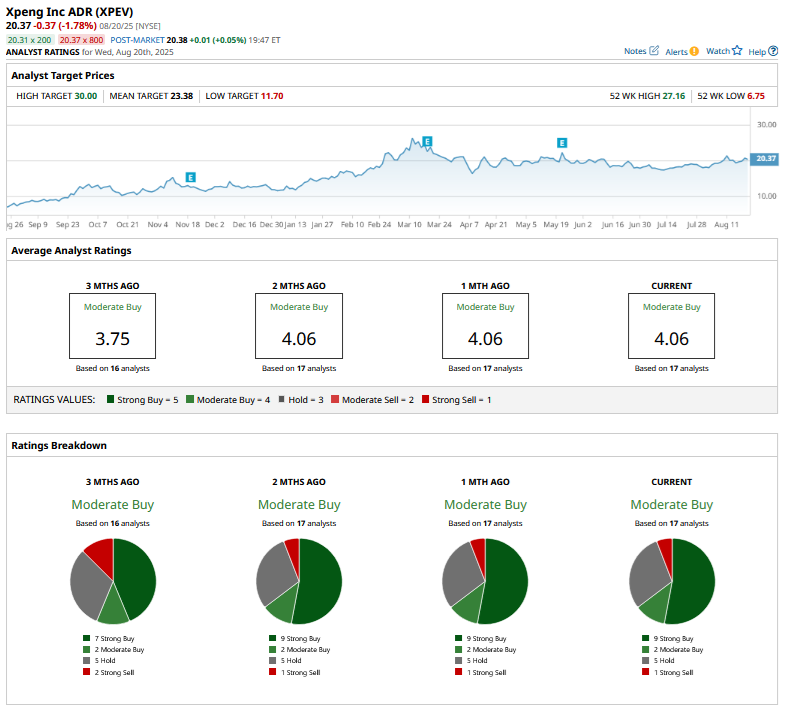

The Chinese electric vehicle (EV) industry is plagued by a price war, which is especially taking a toll on startup names in the sector. Xpeng Motors (XPEV), however, stands out among startup Chinese EV companies this year with YTD gains of 93%. The company has impressed with strong deliveries, which rose to a record high last month, as well as an improvement in its financial performance. The company’s Q2 2025 earnings, released earlier this week, were also better-than-expected and helped justify its YTD outperformance over peers like Nio (NIO) and Li Auto (LI) as well as U.S.-based rival Tesla (TSLA). In this article, we’ll examine why XPEV might continue its rally in 2025 and beyond.  Will XPEV Stock Rise More in 2025?I have been bullish on XPEV for some time now, and the stock hasn’t disappointed me. Here are the five reasons I believe Xpeng Motors might continue its rally. 1. Delivery Ramp Up with New Models The company’s new models have been quite successful, and it is looking to launch several new models beginning with the refresh of the P7, for which it has received the highest preorders in its history. During the Q2 earnings call, Xpeng Motors’ CEO He Xiaopeng expressed optimism that the P7 would be among the top three selling models in the RMB 300,000 segment. He predicted that the company’s monthly deliveries, currently in the 30,000s, will surpass 40,000 beginning in September as it starts delivering the refreshed P7. In December, Xpeng will introduce its X9 Kunpeng Super Electric Edition, its first extended-range electric vehicle (EREV) with an electric range of 450 kilometers and a combined range of 1,500 kilometers. EREVs are quite popular in China, and Xpeng Motors intends to launch more of these in the coming years. EREVs would help Xpeng Motors expand its total addressable market and would eventually lead to higher deliveries. 2. International Expansion Despite tariffs in several regions, including Europe, Xpeng Motors’ overseas sales more than tripled in the first half of the year to 18,000 units, and it is now the top-selling Chinese startup EV brand in 10 markets, including Norway and France. Notably, Chinese automakers are gaining traction in Europe even as Tesla (TSLA) continues to lose market share there, in part due to CEO Elon Musk’s political entanglements. 3. Strategic Partnerships Xpeng Motors has expanded its partnership with Volkswagen (VWAGY) and expects the IP licensing revenues from the partnership to increase in the second half of 2025. The company is also open to global partnerships for its Turing artificial intelligence (AI) chip. The Volkswagen partnership and any further such deals would help buoy XPEV’s margins and cash flows. 4. A Clear Path Toward Profitability Xpeng Motors’ vehicle gross margins were 14.3% in Q2, 3.8 percentage points higher than the previous quarter. It marked the eighth consecutive quarter of an increase in margins, which is no small feat considering the price war in China. The company reiterated its guidance of achieving profitability in the final quarter of this year. 5. Advancements in Autonomous Driving and Humanoids While currently none of the players in the EV race, including Tesla, have full L4 autonomous driving capabilities, Xpeng Motors is hopeful of mass-producing L4-capable vehicles in 2026. It also plans to launch pilot robotaxi services in some regions. During the Q2 earnings call, Xiaopeng said the company is “actively preparing for mass production” of its humanoid in the back half of next year. At the AI Tech Day later this year, Xpeng will unveil its next generation of humanoids. Xpeng Motors’ stock could see further rerating as it advances its autonomous driving and humanoid business. Xpeng Motors’ Stock ForecastSell-side analysts have also been warming up to Xpeng Motors, and it now has a “Strong Buy” rating from 53% of analysts as tracked by Barchart, while the corresponding number three months back was under 44%. Xpeng Motors’ mean target price of $23.38 is 14.8% higher than the Aug. 20 closing price, while the Street-high target price of $30 is 47% higher.  Xpeng Motors trades at a forward enterprise value-to-sales multiple of 1.27x, which is higher than Chinese peers like Nio, Li Auto, and Zeekr (ZK). However, I believe Xpeng Motors has earned the right to trade at premium valuations due to its strong execution. Also, its progress in autonomous driving and robotics – which apparently are the key drivers of Tesla’s valuations – warrant a higher multiple. While not an apples-to-apples comparison, the corresponding multiple for Tesla is 10.19x. I believe Xpeng Motors (XPEV) is one Chinese company that comes quite close to Tesla in strategy as well as ambitions and has the potential to become the “Tesla of China” - a classification once reserved for Nio. Overall, I find Xpeng Motors as one of the best ways to play the EV, autonomous driving, and humanoid story in China and see the stock rising higher from these levels. On the date of publication, Mohit Oberoi had a position in: XPEV , LI , NIO , TSLA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|