|

|

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Bullish Analysts, Options Traders Expect New Highs for Nvidia Stock After Earnings

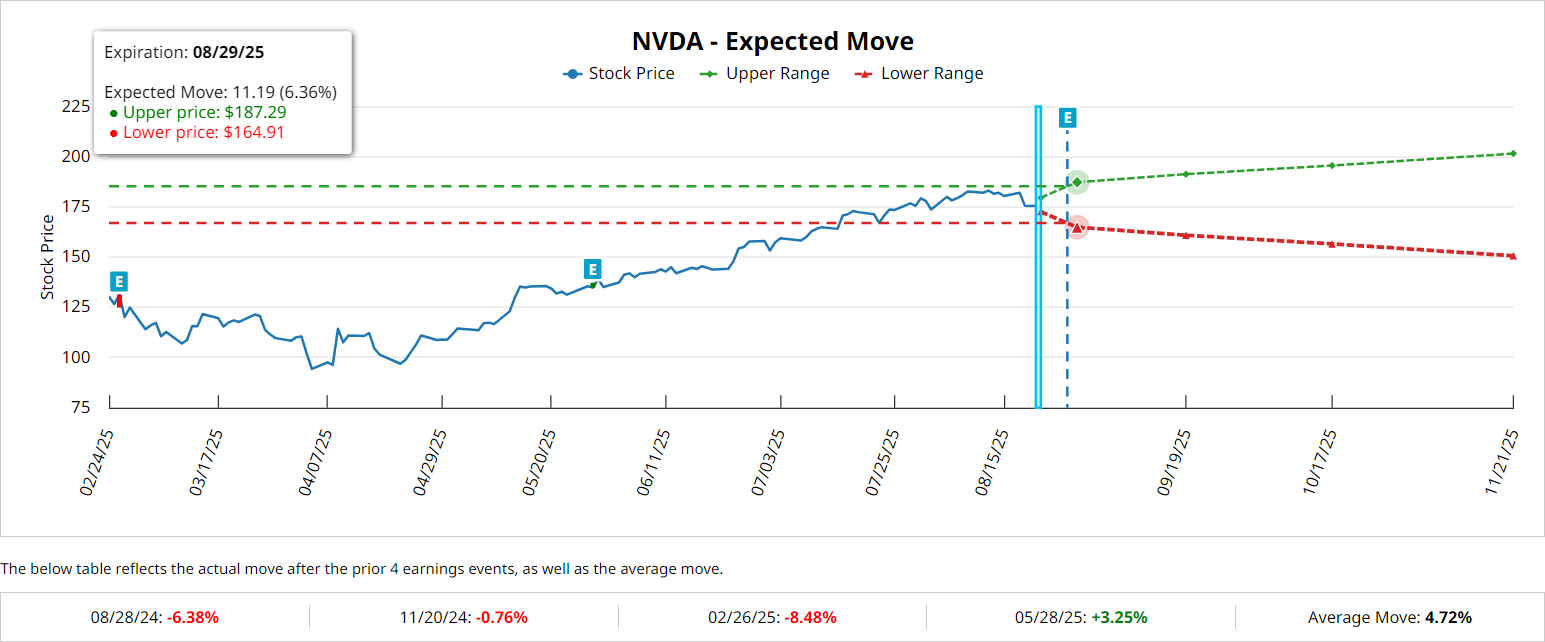

We’re only a week away from the official Nvidia (NVDA) earnings reaction, and analysts are weighing in today with new bullish notes on the artificial intelligence (AI) semiconductor giant. Wedbush upped its price target on NVDA stock to $210 from $175 with an “Outperform” reiteration, noting “ubiquitously positive” hyperscaler spending stats during Q2, while UBS lifted its target on NVDA to $205 from $175 with a “Buy” endorsement. With NVDA around $175 today, these forecasts are calling for an additional 17-20% upside. The stock’s current all-time high is $184.48, set on Aug. 12.  The stock has been under scrutiny amid recent concerns over lofty AI valuations, with the company trading at 40.38x forward earnings. However, Morgan Stanley notes that Nvidia remains the most under-owned mega-cap tech stock relative to its 7.37% S&P 500 Index ($SPX) weight, suggesting the potential for increased institutional buying. What to Expect When Nvidia Reports Q2 EarningsNvidia is set to release its Q2 FY2026 earnings after the closing bell on Wednesday, Aug. 27, with analysts projecting revenues of $45.91 billion, representing a remarkable 52.8% year-over-year growth. Ahead of the event, options traders are pricing in a post-earnings reaction of 6.36% in either direction for NVDA stock - almost exactly in line with the magnitude of the chip giant’s year-ago earnings decline. On average, NVDA tends to move 4.72% the day after earnings, based on the last year’s worth of data.  On the upside, a bullish move of more than 6% from here would place NVDA at new highs above $186 per share. Currently, the put/call ratio shows a preference for calls in the weekly Aug. 29 options series. The Bull Case for NvidiaNvidia's data center segment, which now accounts for nearly 90% of revenue, continues to demonstrate exceptional strength, growing 73% to $39.1 billion in Q1 FY2026. This growth is primarily driven by major cloud providers including Alphabet (GOOG) (GOOGL), Meta (META), and Amazon (AMZN), all of which have significantly increased their 2026 capital expenditure forecasts for AI infrastructure. The company’s technological leadership is also strong, particularly with its new Blackwell architecture and GB300 GPU, which offers 50x faster AI inference than previous generations. Nvidia maintains an impressive 92% market share in data center GPUs and is currently producing approximately 1,000 NVL72 systems weekly, equivalent to 3.7 million Blackwell GPU chips annually. CEO Jensen Huang's strategy of annual GPU releases and substantial R&D investment, at approximately 10% of revenue, has helped maintain Nvidia's competitive edge. Key Risks for Nvidia Right NowDespite strong current performance with gross margins in the low 70% range, Nvidia faces several challenges – including customer concentration risk, with two clients accounting for 30% of revenue. And while Nvidia maintains its position as the world's most valuable company, with a market cap of $4.27 trillion, it faces mounting competitive pressures from rivals like Advanced Micro Devices (AMD), and as some major customers develop internal AI chips. Trade with China is also a major overhang. The company recently secured approval to resume H20 chip sales to the mainland under an arrangement requiring 15% of revenue to be paid to the U.S. government. However, Chinese regulators are reportedly discouraging domestic firms from purchasing these chips as municipalities target 70-90% self-sufficiency in AI chips by 2027. Elsewhere, the EU has committed to purchase at least $40 billion worth of US AI chips as part of a broader trade agreement. Uncertainties aside, the overwhelming majority of Wall Street analysts remain bullish on “Strong Buy”-rated NVDA, projecting that revenues could reach $300 billion by 2026 driven by AI adoption. In the short term, though, investors should continue to monitor risks around China sales, valuation levels, and the potential for a deeper market rotation away from tech leaders. This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever. On the date of publication, Elizabeth H. Volk had a position in: NVDA , AMD . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|